WebPay's High-Risk Merchant Account

Are you a high-risk business owner? And struggling to get a high-risk merchant account. Don't worry; you have reached the right destination. Getting the best high-risk merchant account is the most significant requirement for your business to start taking online payments. We are not blowing our own trumpet but revealing to you the truth that WebPays is what you all need. WebPays is a complete pack of high-risk payment processing that has all high-risk payment solutions. In this blog, we will learn how WebPays is the best and what it has to offer you. Let's begin with its meaning.

What is a High-Risk Merchant Account?

A high-risk international merchant account is a type of merchant account specifically designed for businesses considered to be high-risk by payment processors and financial institutions. It allows a merchant to accept, hold and withdraw customer funds. Due to the increased risk associated with these businesses, payment processors and financial institutions charge higher fees and impose stricter rules and requirements for these merchants to obtain and maintain a merchant account. But WebPays, in its online merchant account, offers the lowest MDR rates and straightforward rules to ensure payment safety to high-risk businesses.

What Makes a Business High-Risk?

Banks and other payment processor companies may regard online businesses as high-risk for multiple reasons (mentioned in the infographic). WebPays, on the other hand, believes that adequate merchants should be allowed to execute online transactions on their payment platforms. Your online business may also be considered high-risk due to the following factors:

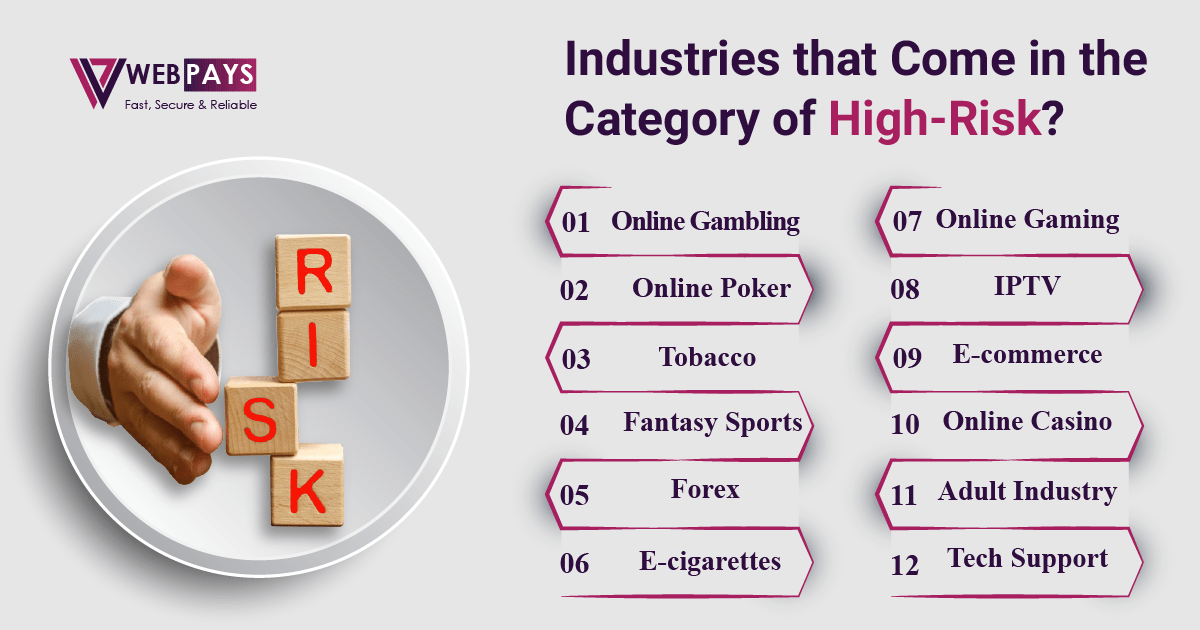

Industries that Come in the Category of High-Risk?

Sometimes a merchant with a good credit score and low chargeback volume finds it hard to get a merchant account because of industry type. Banks and payment processors categorised these industries as high-risk due to the factors mentioned earlier:

| Online Gambling | Online Poker | Tobacco |

| Fantasy Sports | Forex | E-cigarettes |

| Online Gaming | IPTV | E-commerce |

| Online Casino | Adult Industry | Tech Support, etc. |

These are the industries in which merchants need to acquire a high-risk merchant account or industry-specific merchant accounts. WebPays’ industry-specific merchant accounts are specially created masterpiece with the fusion of high-risk and industry-specific features. These masterpiece are:

| Online Poker Merchant Accounts | IPTV Payment Gateway |

| Forex Merchant Account | Online Casino Merchant Account |

| E-cigarette Merchant Accounts | Tobacco Merchant Accounts |

Why High-Risk Merchant Account is the Only Solution for High-Risk Businesses?

You have to accept that most high-risk businesses are unregulated and offer services that are only partially authorized. Once you admit this, it will help you leave your comfort zone and encourage you to discover specialized solutions for high-risk industries. Suppose merchants do not consider the fact and acquire a regular merchant account by altering documentation or fibbing with the acquirer. In that case, they suffer account blockage, fund seizure, and similar actions and ultimately lose their hard-earned money.

On the other hand, If they accept it and acquire a high-risk payment processor for their high-risk businesses, they get a secure, smooth and seamless payment experience without fearing the loss of their hard-earned money, pushing them to go beyond their limits. High-risk merchant account provider offers their state-of-the-art- services, despite knowing these merchants are unregulated. It is also true that they charge a little higher fees than regular merchant service providers because of their auxiliary services that help safeguard merchants. These services are:

- They provide personalized payment solutions for each merchant according to their unique needs.

- High-risk merchant account providers are equipped to handle the inherent risks associated with certain industries and provide top-notch security.

- They have systems and protocols in place to monitor transactions, detect fraudulent activities, and reduce chargeback ratios.

- They typically have robust chargeback management systems in place that help businesses reduce the occurrence of chargebacks.

- High-risk merchant account providers have in-depth knowledge and experience in dealing with high-risk businesses.

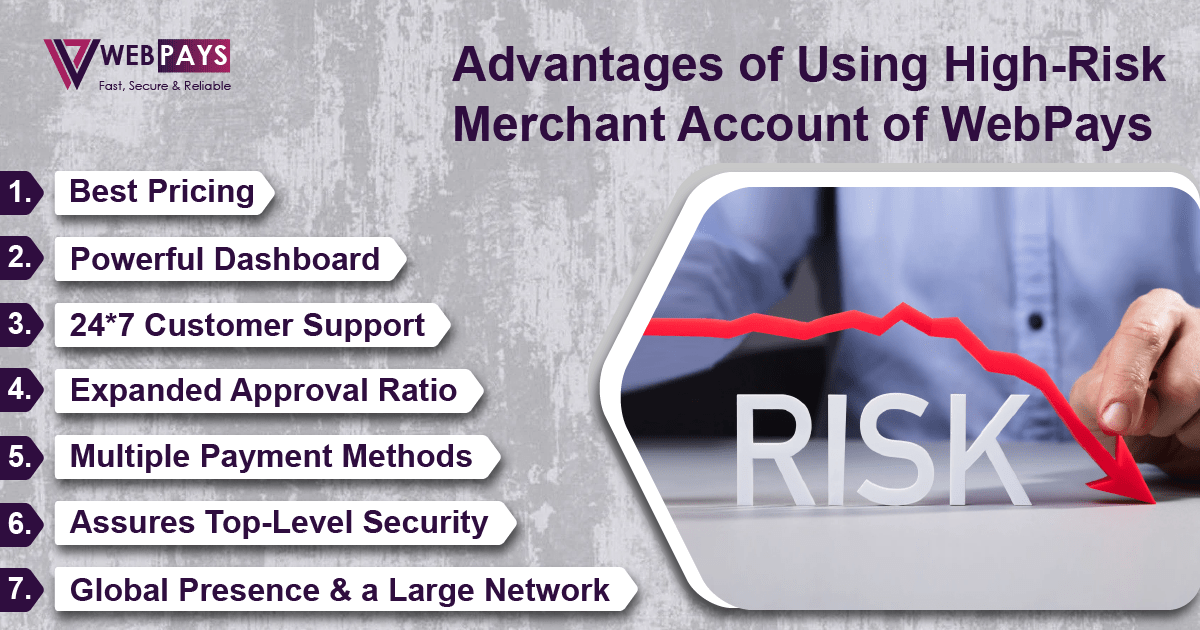

Advantages of Using High-Risk Merchant Account of WebPays

By acquiring WebPays as your payment partner, you can get multiple benefits for your online business comprising:

- Global Presence and a Large Network: We have a presence in over 100 countries and can assist you in expanding globally through our global payment gateway. Moreover, we have associations with multiple acquiring banks to deliver the best payment processing services for high-risk businesses.

- Assures Top-Level Security: With WebPays, you will get assurance for top-level security of online transactions via multiple security features, such as encryption, SSL, tokenization, 3D secure authentication, PCI-DSS compliance, advanced chargeback prevention tools, and so on.

- Expanded Approval Ratio: Our main objective is to support high-risk businesses to achieve business goals in the marketplace. When others reject, we deliver payment services with a 98% approval ratio for high-risk payment gateway services. Yet, we always support you even if you do not have a perfect credit score or need some modifications.

- Multiple Payment Methods: We enable you to accept payment in 35+ alternative payment methods along with 80+ international currencies. This helps you increase customer retention and expand your client base.

- Powerful Dashboard: Webpays provides a powerful dashboard in which merchants can get real-time notifications and a comprehensive analysis of all online payments. It helps to make informed decisions.

- Best Pricing: We have been providing merchants with the lowest prices for many years and still offer the lowest MDR.

- 24*7 Customer Support: At WebPays, our technical/customer support team are available 24*7 to resolve any issue you may face.

These are the main features WebPays offer. We also offer Recurring-based Payments, International Card Saving, One-Click Checkout, Multilingual Options, Invoicing Options, etc., in our high-risk payment solutions.

Conclusion

In conclusion, a high-risk merchant account is the ultimate solution for businesses operating in high-risk industries. With WebPays, these businesses can overcome the challenges of obtaining a merchant account and start accepting online payments confidently. WebPays' high-risk merchant account combines essential features such as global reach, top-level security, high approval ratios, multiple payment methods, a powerful dashboard, competitive pricing, and dedicated customer support. By choosing WebPays, high-risk businesses can thrive in the online marketplace and confidently achieve their business goals.