Global Payment Gateway: The Key to Success in the Global Trade

If you are a business owner that sells or aims to sell its goods or services globally, you have reached the right destination. This article will cover all aspects of global businesses and their payment solutions. So, let's start with the definition of a global payment gateway.

What is a Global Payment Gateway?

A payment gateway is a mechanism that facilitates the transfer of electronic payments. It gathers the payment information from the customer, secures it, and transfers it between the involved parties for payment completion. Fundamentally, a global payment gateway is similar to a payment gateway, but it has some additional features for international businesses. A global payment gateway allows merchants to accept multi-currency and multi-method payments from customers all over the world. It eliminates the intricacy of currency conversion and provides an auto-currency conversion mechanism, which smooths the checkout experience.

A global payment gateway has become a necessity for today’s businesses as the cross-border sales graph is flying. As per UNCTAD, global online trade was reported at $26.7 trillion in 2019, representing 30% of that year’s global GDP. One in every two online shoppers prefers to shop from cross-border businesses, whether for goods or services. And when it comes to industries like online gaming, gambling, forex trading, IPTV, adult entertainment, tobacco, and other high-risk industries, the preference rises to 84% for cross-border businesses. It is clear that a global payment gateway provider is essential to keeping your business's growth vertical. Let’s understand how this essential tool works.

How Does a Global Payment Gateway Work?

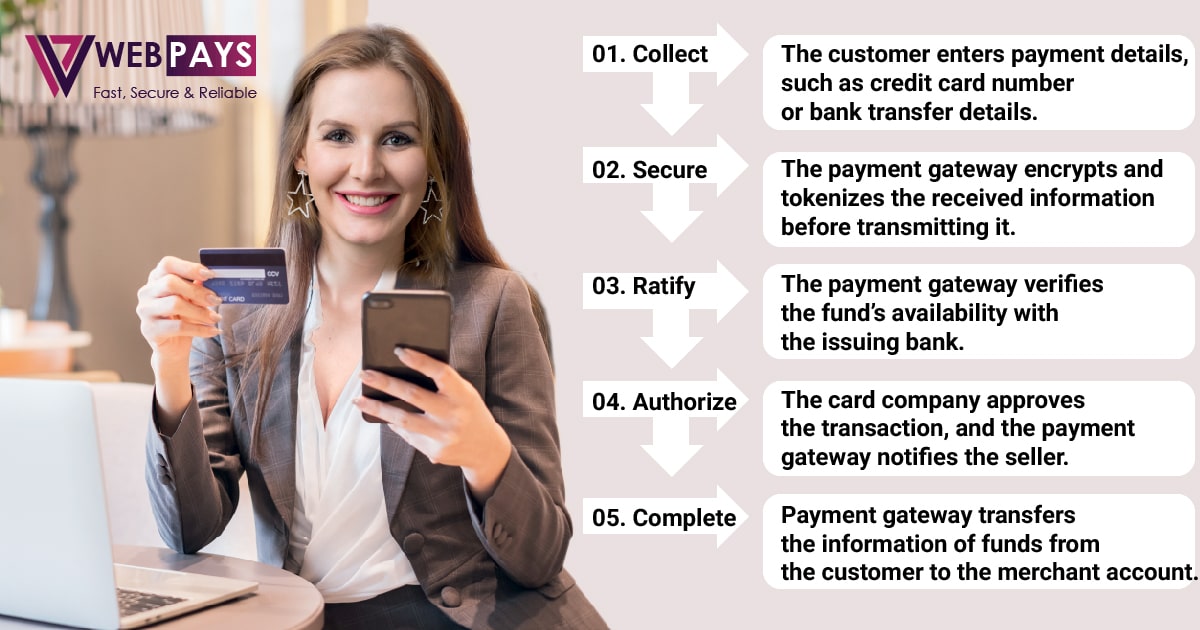

A step-by-step explanation of how a global payment gateway works:

- Customer Checkout: A customer selects products or services and proceeds to pay in his local currency on an online store's website.

- Payment Method Selection: The customer chooses their preferred payment method (e.g., credit card, PayPal, or other options) and enters details.

- Data Encryption: The payment gateway encrypts and tokenizes this information to ensure secure transmission.

- Payment Request Transmission: Secured payment details are sent to the payment gateway's server.

- Authorization Request: The payment gateway forwards the payment details to the relevant payment processor or bank.

- Authorization Response: The payment processor assesses the transaction for legitimacy and fraud. It sends an approval or decline response back to the payment gateway.

- Customer Notification: The customer receives an immediate response on the website, confirming the transaction's status.

- Settlement: If approved, the payment processor initiates settlement, transferring funds from the customer's account to the merchant's in the merchant's preferred currency.

- Reporting: The payment gateway provides transaction reports to the merchant for accounting and tracking.

- Payout: Merchants can transfer funds from their international merchant account to their bank.

Traditional Global Payment Gateway vs. WebPays' Global Payment Gateway:

| Measures | Traditional Global Payment Gateway | WebPays' Global Payment Gateway |

|---|---|---|

| User-Friendly Interface: | Traditional gateways often have complex interfaces that may require technical expertise to navigate effectively. Integration can be time-consuming and cumbersome. | WebPays offers an intuitive and user-friendly interface designed for both technical and non-technical users. Integration is simplified, allowing businesses to start accepting payments quickly and easily. |

| Global Reach and Currency Support: | Many traditional gateways have limited global reach and offer support for a restricted set of currencies. Expanding internationally can be challenging. | WebPays provides extensive global reach, enabling businesses to accept payments from customers worldwide. It supports a wide range of currencies, making it easier for businesses to enter new markets. |

| Security and Fraud Prevention: | Security measures in traditional gateways may be adequate but not always up to date. Businesses are often responsible for implementing additional security layers. | WebPays places a strong emphasis on security and fraud prevention. It incorporates advanced fraud detection tools and complies with industry standards, such as PCI-DSS and GDPR, reducing the risk of fraudulent transactions for businesses. |

| Cost-Effectiveness: | Traditional gateways often charge high setup fees, monthly fees, and transaction fees, which can eat into a business's profits. | WebPays offers competitive pricing with transparent fee structures, reducing the overall cost burden for businesses. It allows businesses to optimize their payment processing expenses. |

| Customization and Branding: | Traditional gateways may limit customization options, leaving businesses with generic payment pages that do not align with their branding. | WebPays allows for extensive customization and branding, enabling businesses to create a seamless payment experience that aligns with their brand identity. |

| Customer Support: | Customer support from traditional gateways may vary in quality and responsiveness, potentially leading to downtime and lost revenue during technical issues. | WebPays provides excellent customer support with a dedicated team that is readily available to assist businesses with any issues or inquiries, ensuring uninterrupted payment processing. |

| Industry Support: | Traditional global payment gateways only support low and mid-risk industries. They do not offer their services to high-risk businesses. | WebPays' global payment gateway is available to all sizes and types of industries, whether high-risk or low-risk. We offer services for the online gaming, gambling, casinos, poker, adult entertainment, tobacco, e-cigarette, IPTV, and forex trading industries and help them achieve new heights. WebPays is available for both regulated and unregulated businesses. |

| Approval Timings: | Traditional payment gateway providers procrastinate. They took weeks, even months, to approve a payment gateway application. | WebPays offers quick approval and guides merchants in collecting necessary documents and formalities. In some cases, we also offer instant approval for global payment gateways. |

| Additional Services: | Traditional payment gateways usually do not offer any additional services. Merchants have to find each and every service they require by themselves. | WebPays is a full-stack payment processor and offers numerous payment solutions, such as merchant accounts, high-risk merchant accounts, international merchant accounts, offshore payment gateways, and industry-specific merchant accounts. Moreover, we also offer additional services like fraud and chargeback prevention and risk management systems. |

While traditional global payment gateways have been the norm for many years, WebPays' global payment gateway offers a modern, user-friendly, and cost-effective alternative. With its global reach, enhanced security, customization options, responsive customer support, and support for all, WebPays is a compelling choice for businesses looking to streamline their payment processing and expand their global presence. By embracing WebPays, businesses can stay competitive in an increasingly globalized market. So, if you are a business waiting for the best, the best has arrived. Let us help you expand globally and boost your revenue. Apply now for quick approval.

Frequently Asked Questions (FAQs) about the Global Payment Gateway:

1What is a global payment gateway?

A global payment gateway is an online service that facilitates secure and efficient electronic transactions between businesses (merchants) and their customers. It enables businesses to accept payments from customers worldwide, typically supporting various payment methods and currencies

2 How does a global payment gateway work?

A global payment gateway works by securely transmitting payment information between a customer's bank or financial institution and the merchant's payment processor. When a customer makes a purchase, the gateway encrypts the payment data, verifies it, and authorizes the transaction. It then sends confirmation of the transaction's success or failure to the customer and the merchant.

3What are the benefits of using a global payment gateway?

Using a global payment gateway offers several benefits, including:

- Global Reach: Access to customers worldwide.

- Security: Enhanced security measures to protect against fraud.

- Convenience: Streamlined payment processing for both businesses and customers.

- Currency Support: Ability to accept payments in multiple currencies.

- Reporting: Detailed transaction reporting and analytics.

- Integration: Easy integration with websites and online platforms.

4 Is it safe to use a global payment gateway for online transactions?

Yes, reputable global payment gateways employ robust security measures, including encryption, tokenization, and fraud detection, to safeguard sensitive payment data. It's essential to choose a trusted payment gateway and follow best practices for online security.

5 How do I choose the right global payment gateway for my business?

To choose the right global payment gateway, consider factors like:

- Supported payment methods and currencies

- Transaction fees and pricing structure

- Security features

- Integration options with your website or platform

- Customer support and reliability

- Reputation and reviews in your industry